Uber Insurance Quotes

If you’re an Uber driver, it’s important to have the right car insurance coverage to protect yourself and your passengers. While Uber does offer some insurance coverage for drivers, it may not be enough to fully protect you in the event of an accident. That’s why many Uber drivers opt to purchase additional car insurance coverage to ensure they’re fully covered on the road. With the right car insurance coverage, you can drive with peace of mind and focus on providing the best possible service to your passengers.

Uber provides some basic insurance coverage for drivers and passengers while the app is on and during a trip. This includes third party liability and contingent comprehensive and collision coverage. For comprehensive protection, drivers need their own private fully comprehensive motor vehicle insurance policy. This covers them when not working for Uber.

What are the Uber Vehicle insurance requirements?

Are you a Uber owner and you are looking for insurance that will cover your business an fleet of car you use to transport people around? Insurance expert can help you find the perfect insurance company in South Africa that can take care of your business at the time of service. Compare a range of business insurance quotes specialists are waiting to assist you ask about fleet insurance for commercial vehicles and trucks. Convenient uber insurance quote are available submit your details for cheap quotes.

Uber provides basic coverage but drivers need comprehensive personal policies for full protection when driving for Uber in South Africa.

Insurance for ride-hailing service

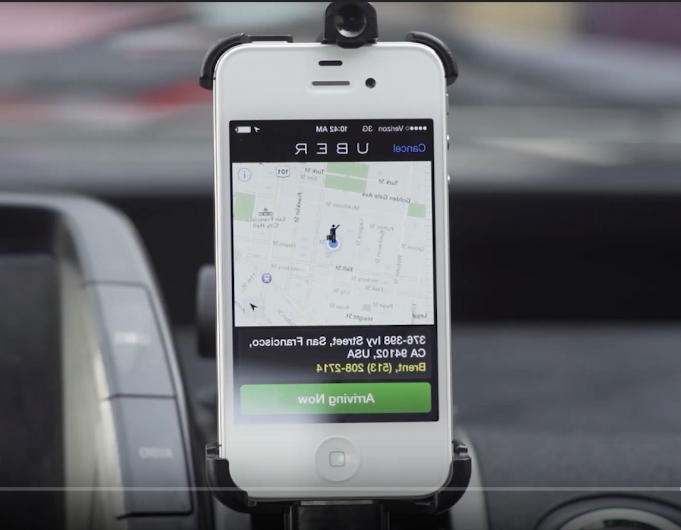

Uber is a well-known ride-hailing company that has transformed the transportation sector. With millions of customers worldwide, Uber offers a practical and inexpensive means of transportation. However, this convenience also necessitates that the driver and passenger have the appropriate insurance coverage. Uber coverage can help with that.

Insurance for ride-hailing services in South Africa is a critical aspect of ensuring the safety and protection of both drivers and passengers. As ride-hailing services have gained popularity, insurance providers have developed specialized coverage options tailored to the unique risks faced by drivers in this industry. These policies typically include coverage for accidents, liability claims, and property damage, taking into account the commercial nature of the ride-hailing business.

Uber drivers may get protection through a program called Uber Insurance. Many jurisdictions have laws requiring this insurance, which covers drivers while they are working. Many different provide Uber coverage, including Hollard Insurance, one of the top Uber Insurance suppliers in South Africa.

Uber Car insurance quote online South Africa

Here is a list of popular insurance companies in South Africa you can read about. Request advice for coverage for uber cars south africa.

The requirements for insurance that have to be fulfilled in order to drive with Uber are

It is essential for ride-hailing drivers to secure appropriate insurance coverage to comply with local regulations and protect themselves and their passengers. By working with insurance providers experienced in the ride-hailing sector and understanding the specific coverage needs, ride-hailing service providers in South Africa can ensure the safety and security of their operations.

- Comprehensive commercial business insurance cover

- Car insurance third party liability cover.

Uber coverage offers extensive coverage for both the driver and the passenger, which is one of its best features. This includes liability insurance, which offers protection in the event that the motorist is involved in an accident and damages or injures someone else’s property. In case the driver’s automobile is damaged or stolen while on the job, Uber Insurance also offers coverage for the driver’s vehicle.

Additionally, Uber coverage is intended to be inexpensive, making it available to drivers from all socioeconomic backgrounds. With so many various coverage choices available, drivers may pick the one that best suits their needs and tailor their insurance to match their budget.

- Drivers should inform their personal insurers that they drive for Uber part-time. This may require switching to a usage-based commercial policy.

- Passengers wishing to have maximum coverage could consider taking out their own supplementary travel insurance when using Uber.

- Uber’s insurance applies only after the driver’s own policy is exhausted. Understanding the coverage gaps is important.

- Accurate information must be provided during sign up. Incorrect details could lead to rejected claims.

- Drivers are advised to thoroughly read Uber’s insurance terms and understand claim procedures.

Compare Uber car insurance South Africa

What insurance coverage is recommended for Uber?

- The best option is to cover your vehicle for full Commercial usage which automatically includes private usage. This will ensure that your vehicle is properly covered and you will avoid your claim being rejected at claims stage due to incorrect type of cover the vehicle is insured for. Plus Commercial insurance policies have greater liability limits on the vehicle as compared to personal insurance policies besides the fact that an insured vehicle that is used for Private use excludes the transportation of fare paying passengers. So all in all, Passenger commercial insurance policies are best insurance coverage.

Learn about Insurance type for drivers

- In terms of the type of cover, Comprehensive cover is best suited for an Uber driver although you can still select specific perils that you would like to be insured for like insuring your vehicle for 3rd party liability cover, Fire and Theft only. With Comprehensive cover, your vehicle will be covered for 3rd party liability, Fire damage insurance and Theft including accidental and malicious damage, glass damage to your vehicle as well as damage by acts of nature like hail damage. The difference between Comprehensive and Limited cover is that Accidental damages to your own vehicle are covered on Comprehensive cover.

- It is also advisable to select additional cover such as Car hire where you will be provided with a rental vehicle to use for a specific period or Vehicle loss of use which pays you a certain amount of money which you can in turn use to rent another vehicle while yours is at the panel beaters being repaired, written off, stolen or hi-jacked.

It pays for shop around for the best insurance for uber rides services.

Another benefit of Uber Insurance is that it provides peace of mind for drivers and passengers alike. With proper insurance coverage in place, everyone involved can feel confident that they are protected in case of an accident or other unforeseen event.

How much does uber insurance cost?

Signup online and get cheap cover for uber taxis, by requesting callback for quotes insurers will quotes you based on the data information you provide. Costs differ from driver to driver calculations are done from your profile.

Uber eats insurance for food delivery

Uber Eats will deliver hot, tasty meals to a customer’s door from their favorite restaurants, and all the customer has to do is tap their smartphone to order. insurance for uber eats drivers in South Africa.

Uber Eats offers minimal coverage, however in order for couriers delivering food for Uber Eats in South Africa to be completely covered at all times, they must have comprehensive personal policies.

Deals on food delivery insurance that are affordable

Compare insurance coverage for couriers utilizing vans, automobiles, motorcycles, mopeds, scooters, or bicycles for all sorts of food delivery.

- Uber Eats provides limited insurance coverage while the delivery partner is actively on a delivery – this includes third party liability and accidental damage coverage.

- However, there are gaps during periods in between deliveries when the app is on but there is no active trip. The courier’s own insurance policy would need to cover these gaps.

- Couriers need their own comprehensive insurance policy to fully protect themselves and their vehicles when not actively on an Uber Eats delivery.

- Coverage also depends on the delivery vehicle being properly

Uber Black owners are also welcome.

Apply in easy steps fill in your details and you will be contacted soon by a qualified insurance consultant and they will insure that you are covered.

In summary, Uber protection is an essential part of being an Uber driver, providing comprehensive and affordable coverage that protects both the driver and the passenger. With its flexibility, affordability, and peace of mind, Uber Insurance is a must-have for anyone looking to earn money as an Uber driver. So if you’re an Uber driver or thinking about becoming one, make sure to consider Uber Insurance from a reputable provider like Hollard Insurance.

Uber insurance cover FAQ

uber insurance brokers

Who is the insurance carrier for Uber?

SA Uber insurance brokers offer low fees, taxi and transport drivers can get cheap insurance quotes online. We’ve partnered with ,the best insurance providers in South Africa the have great offers that you can get in Mzanzi South Africa they have the best taxi insurance deals available for your budget. Compare insurance quotes and get great deals for vehicle best offers for Toyota corolla insurance. Few insurers in South Africa have developed special coverage for Uber e hailing shuttle taxi service, Get your own quotes for personal vehicle insurance policies that commercial use. Expert Uber insurance brokers can arrange, affordable warranties, service plans and insurance quotes. Special management team in Uber insurance can assist you in finding the right Products for your business cover.cheap uber insurance

Can I find cheap Uber insurance? How much is insurance for Uber? insurance rates and premium are calculated on a number of factors. Fill in the form to calculate cheap uber insurance quotes. Review affordable comprehensive business insurance plans, Expert advisors can help you with customized personal insurance cover.

Apply for the right insurance plan for all your uber partners and drivers easily online. Opt for commercial insurance deals that perfect for you small or large business. Calculate uber quotes now no more stressing about insurance.

uber insurance quote

Its easy to apply for Uber insurance quote, all Uber drivers need to have the right insurance cover for their passenger and themselves.

Do Uber drivers need extra insurance?

All driver need to be covered by their own personal car insurance plan. You dont have to stress top insurers can contact you for affordable Uber insurance quotes, fill in the form now and get call back for expert advice when coming to insurance. Cheap affordable quotes are available. Compare several quotes now.

Do you need special insurance for Uber?

Uber transportation services requires all of their drivers to have car insurance in their platform, with Numerous ridesharing, food deliveries, VIP chauffeur to individuals. You can review your own personal car insurance policy. Submit your details for insurance quotes for Uber drivers.

*Based on your profile, your details will be sent to insurance partners that will best serve your needs. That may be a different company than the one featured on this page and form.*

Please Note: We do not represent any company stated or published on our website. We are also not a financial services provider or insurance company.