iWyze Call Me Back Request Service

iWyze Call Me Back is a convenient service that allows customers to request a callback from iWyze Insurance. Whether you have questions, need assistance with a policy, or want to explore insurance options, the Call Me Back feature makes it easy to connect with an iWyze representative. Simply provide your contact details, and an iWyze representative will reach out to you at a time that is convenient for you. It’s a hassle-free way to get the support you need without having to wait on hold or navigate complex phone systems. Experience the convenience of iWyze Call Me Back and get the assistance you deserve.

To get a personalized quote from iWYZE, you can easily get an online rate quote by providing details about your car usage and history. This will give accurate monthly or annual premium estimates.

It’s wise to compare iWYZE’s quotes to other top insurers. While iWYZE offers budget-friendly pricing, other carriers may have better rates depending on your situation.

iWYZE Car Insurance: Protect Your Vehicle and Your Wallet

Looking for affordable and reliable car insurance? Look no further than iWYZE car insurance. Learn about their comprehensive coverage options and get a quote today. iWyze is an insurance company that offers car insurance coverage. When it comes to obtaining car insurance quotes and understanding the cost, there are a few key factors to consider.

It’s a battle of the insurers! Take advantage of the competition and compare quotes online to find the perfect coverage at the right price.

Compare car insurance quotes

What is IWYZE Car Insurance?

IWYZE is a car insurance company that offers competitive rates and coverage. It’s not the cheapest option, but it’s one of the best.

IWYZE offers several different plans for you to choose from, including:

IWYZE Basic – This plan covers damages caused by collisions or vandalism (but not theft). If you want additional protection against theft, choose this plan instead of IWYZE Plus or Elite.

IWYZE Plus – This plan covers all three types of damage–collisions, vandalism and theft–and includes comprehensive coverage as well as liability protection up to R1 million per occurrence in case someone gets hurt while driving your car or even just walking near it! It also includes roadside assistance services like flat tire repair and jump starts if needed during an emergency situation such as losing power due to bad weather conditions like snow storms etcetera.

Car insurance is an essential part of owning a vehicle. It’s important to have the right coverage to protect yourself and your car in case of an accident. But with so many options out there, it can be overwhelming to choose the right policy. That’s where iWYZE comes in. In this article, we’ll explore what iWYZE car insurance has to offer and how it can benefit you.

The cost of car insurance from iWyze can vary depending on various factors, including your age, driving experience, location, type of vehicle, and the level of coverage you choose. Insurance companies assess these factors to determine the risk associated with insuring you and your vehicle. Generally, younger and less experienced drivers, as well as those living in high-risk areas, may face higher premiums.

Read about mutual and federal insurance company. Get the best Customer Service Phone Number Email, Help Center assistance when ever you need it.

To obtain a car insurance quote from iWyze, you can visit their website or contact their customer service. They will typically require information about your vehicle, such as its make, model, year, and any modifications or safety features it has. They will also inquire about your personal details, driving history, and any additional drivers on the policy. Providing accurate information is crucial to receiving an accurate quote.

What Coverage Does IWYZE Car Insurance Provide?

IWYZE offers third-party cover, comprehensive cover and third-party fire and theft cover. These are the three main types of car insurance policies you can get from IWYZE.

- Third-Party Cover: This is the most basic type of auto insurance policy that covers any damages you cause to other people or property in an accident. It also pays for medical expenses if someone else is injured in an accident caused by your vehicle.

- Comprehensive Cover: This covers losses incurred when your car is damaged due to theft or natural disasters (such as floods). It doesn’t include physical damage resulting from accidents with other vehicles or objects such as trees or rocks on the road surface.”

iWYZE offers a range of coverage options to suit your needs and budget. Their comprehensive coverage includes protection against theft, damage, and liability, as well as roadside assistance and car hire. You can also choose add-ons like windscreen protection and cover for your sound system.

iWYZE provides standard coverages like liability, collision, comprehensive, roadside assistance, and more. They also offer innovative options that reduce premiums monthly for safe driving.

Overall, iWYZE is a competitively priced insurer for South Africans wanting quality car insurance without overspending. Compare their quotes to maximize savings on the coverage you need.

iwyze call me back tool service

IWyze Insurance offers a useful feature called the “Call Me Back” function. Customers can use it to ask an iWyze agent to call them back at a convenient time. The Call Me Back function makes it simple to get in touch with the appropriate individual, regardless of whether you have inquiries regarding your policy, want assistance with a claim, or want to look into insurance possibilities. An iWyze representative will get in touch with you as soon as possible if you just supply your contact information and a brief explanation of your inquiry. iWyze contact me feature offers the ease of customized support while saying goodbye to excessive wait periods.

iWyze offers different levels of coverage, including comprehensive, third-party, fire and theft, and third-party only insurance. Comprehensive coverage typically provides the highest level of protection, covering damage to your vehicle, as well as damage to third-party vehicles and property. Third-party coverage is the minimum legal requirement in many places and covers damage to third-party vehicles and property only.

The cost of car insurance is usually presented as an annual premium. This premium can be paid in a lump sum or in monthly installments, depending on the payment options offered by the insurance company. It’s important to note that the cost of car insurance can be influenced by various factors, and it’s advisable to compare quotes from multiple insurance providers to ensure you’re getting the best coverage and price for your needs.

How to Get IWYZE Car Insurance

To get IWYZE car insurance, you’ll need to submit the following documents:

Proof of Identity – Your driver’s license or passport.

Proof of Residence – A utility bill or lease agreement.

To apply for IWYZE car insurance online, visit their website and follow these steps:

Fill out the application form with your personal information (name, address etc.) and payment details;

Upload any required documents;

Review your application before submitting it for review by an underwriter at IWYZE

What to Do After Purchasing IWYZE Car Insurance

Once you’ve purchased your policy, there are a few things that you can do to make sure that everything is up-to-date.

Change Your Address: If you move or change addresses, it’s important to notify IWYZE so they know where to send any documents related to your policy.

Make a Claim: If something happens and someone else damages your car while driving on the road, then this is when making a claim comes into play! The first thing we recommend doing is calling us at 0860 939 493 so we can help guide through the process with ease – we’ll even walk through what needs done step by step over the phone if needed! If possible though try not wasting time waiting around; instead head straight down there with proof showing exactly what happened (i..e pictures) as well as any witnesses who saw what happened firsthand.”

One of the biggest benefits of iWYZE car insurance is its affordability. With competitive rates and discounts for good driving habits, iWYZE can help you save money on your insurance premiums. They also offer flexible payment options and no excess on certain policies.

iWyze Call Me Back Customer Service

Old Mutual iWYZE is known for its excellent customer service. Their friendly and knowledgeable staff are available to answer any questions you may have and assist you with claims. With iWYZE, you can have peace of mind knowing that you’re in good hands.

Benefits of IWYZE Car Insurance

IWYZE car insurance offers a wide range of benefits to its customers. Some of the most popular ones are listed below:

24/7 customer service: You can contact IWYZE anytime, anywhere and get your questions answered by their friendly customer care representatives. They will make sure that you get the best possible service from them at all times.

Fast claim settlement: The company has a dedicated team which works round-the-clock to settle claims as quickly as possible so that you don’t have to wait for long periods before getting back on track with your life after an accident or theft in case such an unfortunate incident occurs while driving around in your vehicle insured by IWYZE Car Insurance Company Limited (ICICI Lombard General Insurance Company).

While cost is an important consideration, it’s also essential to evaluate the coverage provided, the reputation and customer service of the insurance company, and any additional benefits or discounts offered. This will help you make an informed decision when choosing a car insurance policy that suits your needs and budget.

How to Save Money on IWYZE Car Insurance

If you’re looking for ways to save money on IWYZE car insurance, there are a few things you can do. First, choose the right coverage. Second, compare quotes from multiple providers and see which one offers the best price for your needs. Finally, take advantage of any discounts or incentives that may be available through your employer or credit union.

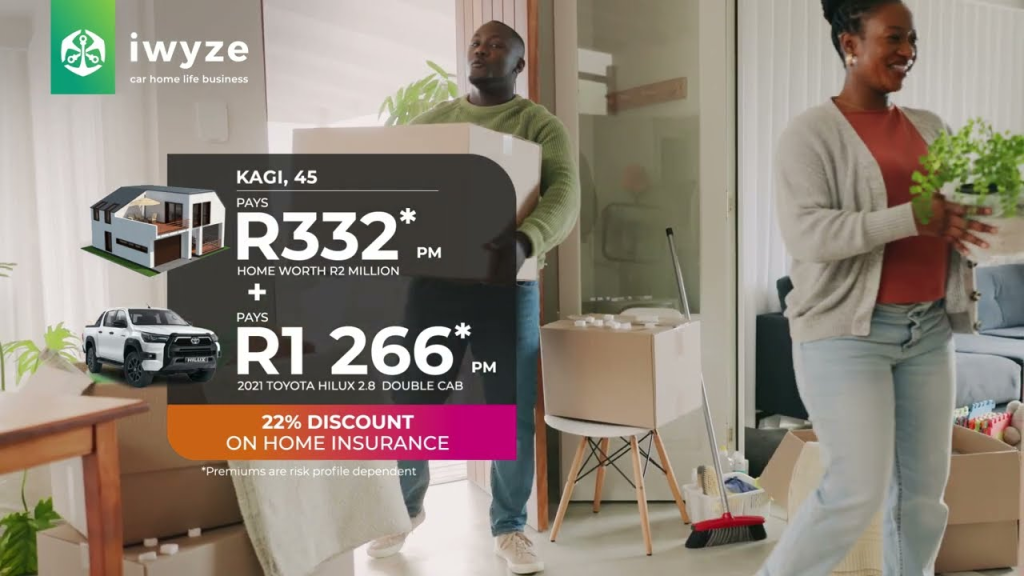

TV Commercial

Use iWyze Call Me Back Service and Choose the Right Coverage

Make sure that the policy you choose has all of the necessary components in place so that it covers all aspects of driving–including liability protection (if someone gets hurt), collision coverage (if you hit something), comprehensive coverage (if something happens outside of an accident), medical payments coverage (if someone else hurts themselves while riding in your car), uninsured motorist protection (UM) and underinsured motorist protection (UIM).

You should also consider adding additional coverages such as roadside assistance or rental reimbursement if they apply to your situation; these can come at an additional cost but could be worth considering depending on how often they would benefit you personally.

Compare Quotes From Multiple Providers

Once again using our website as an example here’s how easy it is: just enter some basic information about yourself including where live geographically within South Africa then click “Get Started Now” button next! We’ll provide instant online quotes based upon these details plus any other relevant factors such as age gender marital status etcetera before sending them directly back over email within seconds flat!”

Common Questions About IWYZE Car Insurance

What is the minimum cover required?

The minimum cover required is R1 million for third party liability, which covers you if you cause damage to another person’s property or injure them in an accident. If you have an older car, this may be all that your insurer requires. However, most new cars have much higher values than this and so it’s worth checking with your insurer about adding additional coverage if necessary. The more expensive your car is and/or more likely it is that someone could sue you for damages caused by an accident (elderly pedestrians), then the more likely it will be worth paying extra for higher levels of protection such as R5 million or even R10 million worth of third party liability insurance.

What is the excess fee?

The excess fee refers to how much money needs paying out-of-pocket when making a claim on behalf of yourself or other drivers who live under your roof (such as family members).

For example: If someone crashes into my car while driving at night without headlights on and causes extensive damage costing R53,000-R72k – I would need pay back only 5% (R450-R3600) because there were no witnesses present who could verify what happened; however if there had been witnesses then I would have had 10% (R5400-$7200) taken off my total payout due to having chosen not having any form whatsoever during those circumstances.”

The above statment is just an example

Map

Conclusion

When it comes to car insurance, iWYZE offers comprehensive coverage, affordability, and excellent customer service. Protect your vehicle and your wallet with iWYZE car insurance. Get a quote today and see how they can help you drive with confidence.

IWYZE car insurance is a great choice for anyone who wants to get the best deal on their car insurance. If you’re looking to save money on your monthly payments, or if you want better coverage at a lower cost, IWYZE can help.

IWYZE offers many different types of policies that will fit your individual needs and budget. Whether it’s comprehensive coverage or liability-only protection, we have an option for everyone!

Leave a Reply

You must be logged in to post a comment.