Jewellery insurance

Personal possessions insurance (commonly known as “all-risk” insurance) is another option. This type of insurance insures all of your everyday goods, along with high-value items like jewellery, you often take with you outside house, to go to an event or meeting.

Own assets insurance is a type of insurance that protects your personal belongings.

Personal liability, coverage for emergency callouts, coverage for goods you move outside the home, such as jewelry or watches, may all be included in your home insurance policy.

Jewellery insurance cost

Jewellery insurance South Africa

You or family who reside with you wear expensive jewelry which might or might not contain valuable gemstones. Among the items provided are bracelets, pin brooches, cuffl-inks, earring, gold pendants, rings, watches, and other items.

jewelry not only enhances your appearance, but it also says a lot about who you are, which is why you shouldn’t keep it in a secure all the time.

If you’re traveling on a lengthy trip, specialized jewelry insurance from a professional supplier could be a good idea.

Jewellery insurance protects your valuables from theft, loss, and damage. Coverage starts right away.

Compare ring insurance South Africa.

Engagement ring insurance with home insurance

You may be certain that valuables like your wedding ring or that lovely 18c white gold necklace you love wearing will be safeguarded in the case of the unforeseeable.

Please keep in mind that the jewelry you insure on a Portable Valuables insurance is the jewelry you wear daily, such as your engagement and wedding rings, rather than your grandma’s antiques, which will be kept in a house safe.

Wedding ring insurance quote

Wedding ring and engagement ring insurance

Your engagement or wedding ring may be the most valuable piece of jewelry you possess, and losing it or having it stolen may be devastating.

Check your policy details and make sure your values are up to date because your insurer may stipulate how often your jewelry has to be revalued.

What is the purpose of an insurance valuation?

A expert valuator of your jewellery is required for more than simply insurance considerations. Other reasons to have your jewelry valuated include:

For the purpose of inheritance (sorting out the estate of a loved one)

Divorce or family dissolution. When it comes to selling jewellery,

What is the cost of jewelry insurance? Apply on the form for exact price information.

If your jewelry is ever lost, stolen, or broken beyond repair, a jewelry appraisal can help you get the information you need to get a replacement. It contains a brief description of the object, including how it is constructed, as well as the insurance worth at the time of valuation.

It’s also crucial to clarify with your appraiser how you’d repair the item, as this has an impact on the sort of assessment generated.

Your valuer will also tell you how often you should have your things re-valued, as precious items and gemstone prices change a lot, and regular valuations guarantee that your insurance values stay accurate.

Gold and diamonds insurance

Gem & Jewel Insurance, which was created in union with specialists in the jewellery and precious assets sector. Compare insurance solutions for retail, commercial, and manufacture jewellers, gem cutters and fixers, watch exporters, coin dealers, and dealers, goldsmiths, diamond and metal producers, and refiners using our knowledge and skills.

High-value precious goods such as diamonds, platinum, gold, and priceless papers are covered by Jewellers experts, whether in transit or in a safe. Mines and mining businesses, as well as diamond dealers and merchants, can benefit from this insurance solutions.

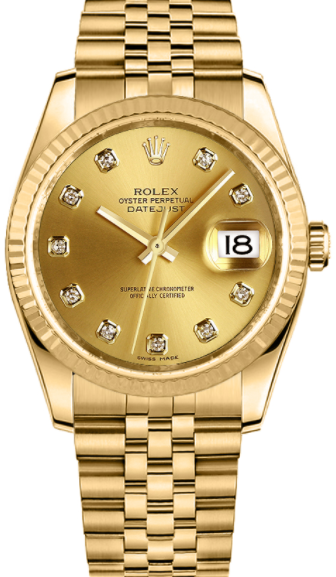

Watch insurance rolex, Jewellery cost

What is the significance of Rolex valuations?

Rolex values are essential for ensuring that you may insure your Rolex watch at a fair replacement cost. This is

especially essential because Rolex watches rise in value and the brand has frequent price hikes.

Because a Rolex watch may cost anywhere from (R 33 935,16) £2,000 second hand to (R 848 379,01) £50,000 or more brand new, it’s critical to get a valuation on the watch at least every two years.

Get the finest Rolex insurance quotation possible, ensuring that your watch is properly protected. Insurance has all the information you need to know about how much to cover your Rolex for.

Claiming

Only you will be dealing with the insurance company.

Only claims raised by you will be handled by the insurance provider. A claim filed by someone else, whether on your behalf or not, will not be considered.

How to Submit a Claim

You must report the damage, loss, or theft to the police within 48 hours. At the police station, you will be required to sign an affidavit detailing the cause of the damage, loss, or theft. You must also obtain a police case number if the insured jewelry was lost or stolen.

When submitting a claim for damage, you must provide your affidavit and evidence of ownership (for example, the sales docket you received when you acquired the insured).

Submit it to the insurance company as proof of your claim.

Leave a Reply

You must be logged in to post a comment.